Streamline Your Billing Process: Adding Expenses to be Billed in QuickBooks Online

Introduction to Adding Expenses

For businesses of all sizes, managing expenses and billing clients accurately and efficiently is paramount to financial success. QuickBooks Online, a robust accounting software, offers a plethora of tools to help streamline this process. One crucial feature that can significantly simplify your billing process is the ability to add expenses to be billed directly within the software. In this comprehensive guide, we will walk you through the steps to add expenses to be billed in QuickBooks Online and explore the benefits of doing so.

Step 1: Understanding Expenses to be Billed

Before we delve into the nitty-gritty of adding expenses to be billed in QuickBooks Online, let’s first understand what this concept entails. Expenses to be billed refer to costs incurred on behalf of a client or customer that need to be reimbursed or billed back to them. These expenses can include anything from travel expenses, supplies, and materials to subcontractor costs.

Step 2: The Importance of Accurate Billing

Accurate billing is crucial for maintaining a healthy cash flow and ensuring your business remains profitable. When you add expenses to be billed in QuickBooks Online, you are taking a proactive step towards precise billing. Here’s why it matters:

- Improved Financial Transparency: By tracking expenses to be billed, you gain better insight into your project or client-specific costs, making it easier to create transparent and detailed invoices.

- Minimized Revenue Leakage: Failure to bill clients for expenses can result in revenue leakage. Accurate billing ensures you recover all costs incurred on behalf of clients, thereby maximizing your revenue.

- Enhanced Client Trust: Transparent and precise billing builds trust with your clients. It shows them that you are committed to fair and honest business practices.

Step 3: Adding Expenses to be Billed in QuickBooks Online

Now, let’s dive into the practical steps of adding expenses to be billed in QuickBooks Online:

1: Log in to QuickBooks Online

- Begin by logging in to your QuickBooks Online account.

- If you don’t have an account yet, I am a QuickBooks ProAdvisor and you can sign up with me directly for an additional discount.

2: Navigate to Expenses

- Once logged in, click on the “Expenses” tab in the left-hand menu.

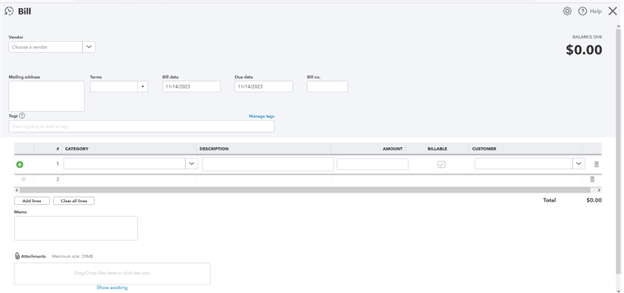

3: Record the Expense

- Click the “New Transaction” button.

- Select “Expense” (already paid i.e., credit card or ACH) or “Bill” (to be paid later) as the transaction type.

- Fill in the necessary details such as the date, payee or vendor, invoice # and category.

- In the “Customer” field, select the client or customer for whom you incurred the expense.

- Enter the amount of the expense and any additional information required.

- You can also upload a copy of the vendor invoice (located below under attachments)

4: Save as Billable

- Toggle on the “Billable” box and click on it to check it off.

- You can add a markup percentage if you wish to charge a fee on top of the expense.

- Verify all details and click “Save and close.”

5: Create an Invoice

- To bill the client, go to the “Sales” tab and click “Customers.”

- Select the client’s name and create an invoice.

- QuickBooks Online will automatically include the billable expense in the invoice. This process will be in a later blog article.

Step 4: Benefits of Using QuickBooks Online for Expense Billing

QuickBooks Online offers several advantages when it comes to managing expenses to be billed:

- Time Efficiency: The process is quick and straightforward, saving you time that can be better spent on other aspects of your business.

- Accuracy: QuickBooks Online reduces the risk of manual errors in billing, ensuring you charge the correct amount to your clients.

- Seamless Integration: It integrates seamlessly with other QuickBooks features, such as invoicing and financial reporting, for a holistic financial management experience.

Conclusion

Adding expenses to be billed in QuickBooks Online is a game-changer for businesses looking to streamline their billing processes and improve financial transparency. By following the steps outlined in this guide, you can ensure that you bill your clients accurately and efficiently, ultimately boosting your bottom line. If you’re ready to take your expense management and billing to the next level, contact us today for a consultation at 413-798-4466. Our team of experts can provide personalized guidance and support to help you make the most of QuickBooks Online’s capabilities.

Bonnie Rose

Sign up for valuable resources, insightful articles and expert advice on bookkeeping and consulting topics to help your business thrive and succeed.